When a user visits your eCommerce marketplace, they’re searching for a good deal on a product or service and a simple and secure payment method. The payment gateways that you integrate with your online marketplace ought to impart trust in your customers as they make their purchases.

An eCommerce marketplace involves hundreds or even thousands of transactions every minute. And so, streamlining orders, sending payouts to different users (buyer, seller, admin), managing refunds, or initiating payments in an eCommerce marketplace could be a complicated process.

There are several complexities involved in the payment process like handling sales tax, ensuring security, managing real-time split payment, and much more. Also, the payment process becomes more complex when buyers and sellers are located in different regions.

What is Stripe Connect?

In the year 2012, Stripe launched Stripe Connect, a new version of its payments service that enables users of any website to accept credit card payments. It meant that now anyone who sells on an online marketplace or uses an online store service, a website creator, or invoicing system could get paid via Stripe.

Stripe co-founder John Collison said, “We want to build the economic infrastructure for the Internet,” and so, they did. The following marketplaces are already using Stripe Connect:

How does Stripe Connect work for an eCommerce marketplace?

According to the details on the official website, Connect is a set of programmable APIs and tools that lets you facilitate payments on your software platform, build a marketplace, and payout sellers or service providers globally.

Whether you want to launch an on-demand, retail, or crowdfunding marketplace, Connect can help you onboard, verify, and pay out your users at scale. But how? Some of the top eCommerce marketplace platforms are pre-integrated with Stripe Connect, providing more valuable offering through powerful payments functionality for your users. Ensure choosing an eCommerce platform that is embedded with Stripe’s powerful, future-proof technology.

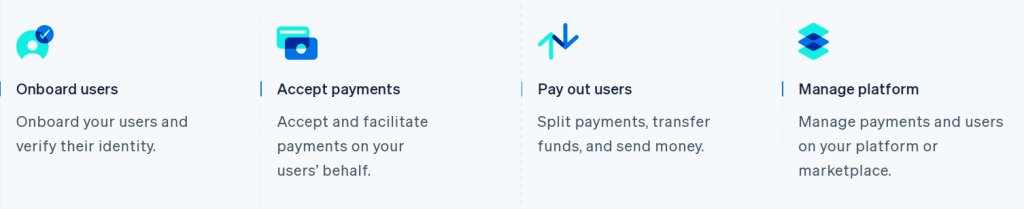

Now, let’s go through the steps involved in the process:

- Onboard Users: Whether you use Connect’s prebuilt, optimized UIs or build your own custom flows, it’s easy to get your users up and running quickly. Stripe handles identity verification to meet Know Your Customer (KYC) and compliance requirements.

- Accept Payments: With Connect, your customers can accept 135+ currencies and dozens of popular payment methods all over the world. Offer payments online, by invoice, or at the point of sale.

- Pay Out Users: Payout users quickly and reduce operational overhead with Connect’s global routing and payout engine. You can split funds between multiple users, instantly route payments across borders, and specify your earnings on each transaction.

- Manage Platform: Stripe helps keep full records of all transactions so that you can easily track and reconcile payments.

Pros of Stripe Connect

Instant onboarding and verification — The Stripe Connect API follows dynamic Know Your Customer (KYC) checks, real-time screening, and other sanctions to approve new users. Moreover, it offers instant onboarding for existing businesses and individuals already using Stripe.

Secure — The payment method is globally licensed, complies with PCI DSS Level 1 certification, and uses account tracking technology with instant disablement to prevent fraudulent users.

Accept payments internationally — Facilitate the flow of funds between users and the marketplace seamlessly even across borders with Stripe Connect. It accepts 135+ currencies globally, ensuring a truly scalable business.

Smart payouts — Collect commissions, schedule payouts, and automatically transfer funds from buyer to seller instantly. Payouts by Connect eliminate the need to track and transfer funds manually.

Cons of Stripe Connect

Slightly Expensive — Stripe Connect charges a nominal 2.9% + $0.30 per transaction on credit card processing and an additional 0.6% fee on each transaction involving an international credit card. Moreover, sellers on the marketplace will have to pay a standard $0.25 fee on direct or ACH payout. Stripe costs a little more than the competitors, but their services are exceptional.

No mass payments — Stripe Connect does not allow the admin to pay multiple sellers at once.

E-commerce Platforms Pre-Integrated with Stripe Connect

There are several eCommerce platforms that have pre-integrated Stripe Connect. For instance, multi-vendor eCommerce platform Yo!Kart, online store creator Shopify, online form builder Wufoo and many more. If you opt for any of these platforms for building your online marketplace, then you are getting Stripe Connect embedded as a payment gateway by default.

For better understanding, let’s take an example. Let’s understand what is Yo!Kart and how Stripe Connect works on the platform.

What is Yo!Kart?

Yo!Kart is an industry-leading multivendor solution that comes with powerful in-built modules like product catalog system, shipping management, tax management, and more. The platform currently empowers more than 1000 eCommerce marketplaces worldwide. Success to Yo!Kart is derived from our agile team that continuously endeavor towards building a future-proof online marketplace software. The pre-integrated Stripe Connect module in Yo!Kart is a step towards further streamlining & automating payments for improved efficiency in an online marketplace. Stripe Connect Split Payment API automates fund transfers and provides real-time split payments which are invaluable for an online business.

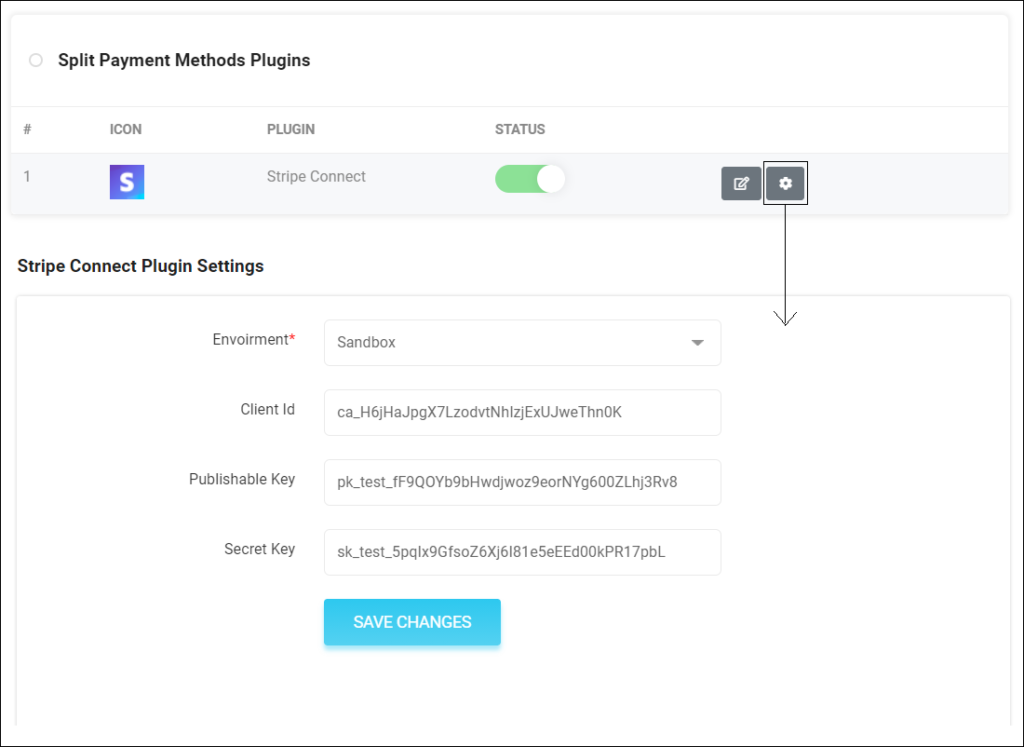

Here is how Stripe Connect is enabled if you are using a marketplaces built with Yo!Kart

To access and enable this feature, go to Plugins -> Split Payment Method under System Settings in the admin dashboard. Once Stripe Connect is activated, the multi-vendor platform will automatically disable regular payment methods like PayPal, Amazon, Bank Transfer, and others.

Want to build an eCommerce marketplace pre-integrated with Stripe Connect? Get in touch with Yo!Kart experts and share your requirements with them.

Still wondering if Yo!Kart is the right platform? Try Demo.

Content Source: https://www.yo-kart.com/blog/