……..and Markets Came Tumbling After

Perhaps, both Dr. Manmohan Singh as Leader of Ruling Party in Power and Mr. Pranab Mukherjee, as Finance Minister went up there, this budget session, to specially put the Indian GDP in higher growth trajectory. Probably all went in vein. All accepted; but then what could be the reason at the route of it? Is anyone interested and involved in finding out the route cause or all are merely trying to make the smart, logical and rational guesses.

Many experts have been found blaming it on the variety of issues, and the sum of these issues is much larger number than all the experts giving their opinion put together. It signals an impression that now a doctoral thesis should be presented on ways of identifying that the individual, who is well dressed and has somehow made it to a position of power and claiming to be expert of domain, is really an expert or a garbage vomiting biological machine.

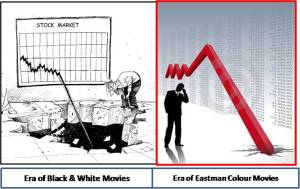

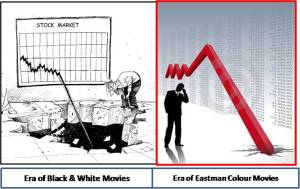

Market Crash of Two Different Centuries 1930 — &–2008

The reasons forwarded by expert for any wanted or unwanted oscillation in the national economy has as much probability of being found in few phrases mentioned below, as much is for any oscillation happening in mood of markets, in next day trading session.

An Attempt:

1. Probably this is an outcome of policy paralysis at the level of Government…

2. It is due to fear being felt by FIIs due to the possible provisions of GAAR on P- Notes…..

3. This is being reflected as the Rupee is getting weaker……

4. It is due stubbornness being shown by RBI Governor by not easing interest rate…

5. It is an outcome of inflationary pressure…..

6. Because European markets opened on lower side…

7. Euro zone crisis is having its impact felt… as all the economies are networked these days….

8. Prices of Crude Oil are moving northwards due to possible stance of USA on Iran’s nuclear issue..

9. The monsoon has cracked a joke on us….

10. The quarter -1 , 2, 3, 4 data for industrial output were not promising….

11. There is a growth being noticed in unemployment rate in USA….

12. Forecast of Chinese economy has taken the fizz out of the market….

13. All this is due to the nation’s money lying in the tax heavens abroad….

14. The growing fiscal deficit is responsible for it….

15. It is the burden of subsidy that is killing the government…..

16. Investors’ are fearful of risky assets and they going for Cash or preferring cash..

17. The Greece crisis has taken its toll….

18. The Spaniards are going uncontrolled……

19. It is due to the Vodafone issue..Where FM wants to put a tax with Retrospective effect..

20. Rupee falters on rupee outflow fear…..

21. Now markets are waiting for first signal of Mr. Hollande, the new President of France.….

…..

,,,,

////

…..

N. The grocery seller was saying that Fed is in for an interest rate hike…..

N+1. I heard my taxi driver telling to someone that it is being stage managed by the government…

N+2. There is a foul smell of some foreign hands behind it…….

This is not the end of the list, and therefore just an illustrative one has been put up. Please feel free to add your suggestions. The names will be sent to Nobel Committee which supposed to announce the Current Years’ Nobel Prize Winner in Economics by conducting a free and fair lucky draw from it…..

Always Yours— As Usual —– Saurabh Singh

Impressions of Visitor & Few Replies