P – NOTES – AN OVERVIEW

Perhaps, since Mr. Pranab Mukherjee, the present Finance Minister of UPA government (2009 – 2014) has presented his finance bill on March 16, 2012, the Term “P – Notes [Participatory Notes]” has transformed or metamorphosed in an instrument of mass massacre at Indian capital markets. Probably in current era we do not have Black Friday but probably a new kind of day, i.e., P – Note day, though the common term “Black Monday” is associated with these P – Notes. Even a rumor on the issue of GAAR and P – Note is good enough to create an epic blood bath in Indian Capital Markets these days.

The class of investors suffering maximum burnt are ‘the new breed of retail investors’, and I feel this to be the worst impact of the event, as this phenomenon may turn the retail investors chary and scary both. Consequently the flow of money to capital markets may decline significantly, rather it may get once again get diverted to safe heavens, i.e., to nationalized bank in India, out of which majority are in cash plus state. This mean the capital that was meant for capital markets will get locked into banks and simultaneously these banks will have to shell out more amount as interest on these deposits; without getting any returns on them (as there are no borrowers available in market, who may love to pick money from bank in the regime of sky rocketing interest rates).

Participatory notes can be found making it to news headlines every alternate day, but due to all bad reasons. They have been in the root of biggest fall witnessed at capital markets in current era. The apex regulatory bodies of Capital Market and Money Market,, i.e., SEBI and RBI are also making it to the headlines of pink paper these days, as they are found issuing notices and warnings to the parties using this instrument.

The financial analysts and experts dealing in or related to Capital Markets are neither concerned nor worried about this instrument, as Indian Investors do not and cannot use this instrument. At the same time they do not have a say in the issue, as it is the government which is supposed decide the fate of Participatory Notes. The P – Notes come into prominence when the deliberations are regarding or related to Foreign Institutional Investors [FIIs].

But what are Participatory Notes [P – Notes]

This as question is circulating in the conscious or sub-conscious part of mind of every individual or retail investor. They are a confused lot due to probably two reasons. First being that till a few months ago they had neither heard about any such instrument nor had they thought that something unknown may throw all their investments plans hay ware. Whereas, the second reason is their failure to comprehend that why it is they, who are paying the cost for something not known, and why the government and market regulators are working towards saving their interests.

An Attempt to Explain what P-Notes Are:

Just like any other derivative ‘Participatory Notes’ too are simply ‘derivative instruments’ that is used by investors not registered in India or Mauritius to trade in Indian markets

Numerous FIIs, which are neither registered nor they wish to get registered with SEBI, but are interested in getting exposure to Indian Securities, place their orders through brokerage houses that have Mauritius-based FII accounts.

These ‘P-Notes’ are generated as a consequence of the action of brokers who buy or sell securities on behalf of their clients on their proprietary account and as a result of the transaction, issue ‘notes’ in favor of such foreign investors. It is these notes which are called in profession of securities trading as “Participatory Notes”. The brokerage houses then repatriate the dividends and capital gains back to these entities, which are generated as a consequence of such trade. In this case, the broker acts like an exchange: it executes the trade and uses its internal accounts to settle the trade. They keep the investor’s name anonymous.

Somehow, anonymous investors are not liked by the regulators of Capital Markets. The recently out, Lahiri Committee Report, also lays emphasis on participatory notes, its role and functioning.

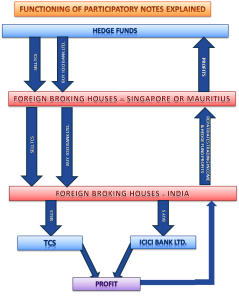

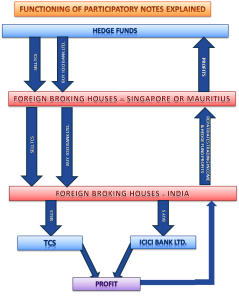

Exhibit – 1: Functioning of Participatory Notes

P-Notes, down the line exhibit properties of Hedge Funds. Although SEBI, as a regulator had issued KYC (Know Your Client) guidelines, which include that, FIIs must know all the requisites details about their client and be able to furnish the details of the same, as and when demanded or asked by the regulator, to which there should be strict compliance, failing which the regulator may sentence them to very harsh punishments or even capital punishments, as was done by SEBI in case of UBS Securities. SEBI barred UBS Securities from trading in Indian markets on this premise only as they could not succeed in furnish the information regarding their clients. Though, finally SAT reversed the SEBI’s order.

The Bigger Issue

The bigger question needs to address the debate on hedge funds and why regulators like SEBI and RBI are wary of them….. ? That will be another topic of discussion with some other headline. For the time being the deliberations stop here.

Author

Always Yours — As Usual — Saurabh Singh

Impressions of Visitor & Few Replies