In late evening, when I had just pressed the shut down button of my workstation, a colleague of mine entered the office chamber (Officially allotted to me to work).Hello, was the first word uttered out by her and before I could ask the purpose, she herself expressed that she planned to have my company while walking back to home, at least the part of distance that was common to we both. I welcomed the idea and also thanked her for the same. Thus the journey homewards started. While on walk the momentary silence was done away by my colleague, when she requested the permission to ask question that was coming to her mind. I agreed to help her to the limited capacity of mine.

Probably it was the prices of yellow metal that were troubling her and my colleague wanted to know, where the prices are expected to move in future and why. This I am inferring from the talks that continued.

She started the conversation by posing her curiosity as ahead: “Where do you see the price of gold going in the days to come?”

Since, at that moment, I was not exactly focusing on ‘investment advisory’, so I responded by saying that “on a broad level, the price are supposed to continue their northward journey.”

It seems that my response confused her a bit, as she soon came up with another question that “what I mean, when I say a broad level.”

I got the point and then explained to her that “the prices of any commodity do not move in a straight line. When I say on a broad level, it means that the prices will keep moving northwards, but in between they may drop as well, but they will pick up again, and thus will continue to scale up.”

It seems, that she was not ready to buy anything that I said, therefore, she questioned that what lay behind my confidence, which she visualized while I was answering her first curiosity.

Suddenly I realized that majority of investors; rarely scan the external and vital economic variables that are often of political nature. This made me aware that now I need to go bit detailed and also in a manner that she could easily comprehend.

“Well, I was just reading through some material and I realized that there is another solid reason for gold prices to go up,” I told her.

“Is it something other than all the money printing that is happening and is likely to happen in the days to come, all around the world?” she asked.

“Yes”, I answered.

“So what is this new reason?” she was now more curious.

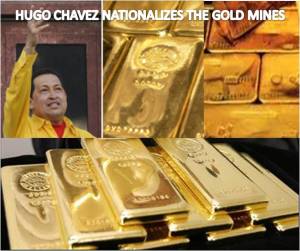

Now I started by posing a question as ahead “Ever heard of Hugo Chavez?” Pat came the reply, “nope” with a supplementary question that now who’s he?

“He is the President of Venezuela, a country in South America.”

Probably she got a bit more confused and said that she knew that, but expressed her surprise on the issue that what “Venezuela” has got to do with the price of gold.

This made me aware that now my job was to explain history, international polity, and international trade, cost of transaction and accounting to her, and all this in very limited time of few minutes. I knew that I may be bombarded with whorls of questions.

I started with letting her know that Venezuela has the 15th largest gold reserves in the world amounting to 401.1 tonnes. A lot of this gold is lying abroad in b anks in New York, London and Zurich.

anks in New York, London and Zurich.

“But why will a country keep its gold overseas?” she interrupted.

I started to introduce her with history. I said that “a part of the reason comes from history. Till August 15, 1971, the world was on a gold standard. Paper currencies were ultimately convertible into gold. This meant that countries had to settle their deficits in gold.” I followed this by giving an instance from international trade. I asked her to assume that England and Germany are exporting and importing goods from each other. At the end if France exports more to England than England to France, there is a deficit.” This means that England had to pay France. This payment was to be made in gold. A look at her face made me feel that she has now started picking up what I was attempting to explain. I carried on by adding that “now this meant that gold had to be physically moved from England to France, which of course was a pain. Movement meant cost of insurance as well as security.”

She was prompt in asking that “what was the way out?”

I added for these reasons “a lot of this gold is simply stored overseas at the Federal Reserve Bank of New York (a part of the Federal Reserve of the United States, the Central Bank of the US).”

“How do you think this is going to help?”

It’s simple; I added and just narrated what Peter Bernstein writes in his book “The Power of Gold”. For example, if England lost gold to France, a guard at the Federal Reserve had merely to bring a dolly to England’s closet, trundle the gold to the French closet, and note the change in the bookkeeping records.’

She got the point, and allowed my request to take her back to Hugo Chavez.

The deliberations continued further, certainly with some statistical inferences. Estimates suggest that nearly 211 tonnes of the 400-odd tonnes of gold that Venezuela has are with banks abroad. Chavez has asked this gold to repatriated back to Venezuela.”

Now this brings a twist in the story, and the discussion to follow will also attempt to answer possible reason for Hugo Chavez’s such an act.

“Chavez has had an anti-US stance for years and may feel that because of that Venezuela runs the risk of its gold being seized.”

“Gold Seized? Why would such happen and does the possibility of such an act exist?” was the latest in series of questions.

“It sure is. I explained the same by making her aware of the ongoing Libyan foreign exchange reserves crisis, which happens to be an outcome of its foreign reserves being seized by allied nations with declaration of war earlier this year.”

“But what has all this got to do with the price of gold? To me it’s as simple as me wanting to have gold in my own locker rather than the bank locker.”

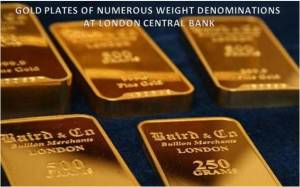

I agreed to her statement, while continuing to explain by adding that all is not that straightforward as concluded by her, though to some extent she was correct. The straight forward part of transaction would be limited to 99 tonnes of total 211 tonnes lying abroad, as this 99 tonnes are deposited with the Bank of England in London. Repatriating that back to Venezuela would be a straightforward process.”

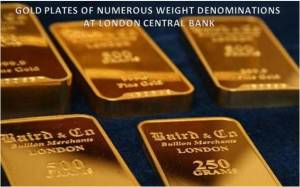

Now comes the not so straight forward part, which happens to be of the tune of 112 tonnes of the gold and same is lying abroad with what are known as bullion banks. J P Morgan is one of them. Estimates suggest that Venezuelan gold worth $807 million (or around 450,000 ounces of gold) is lying with it.”

She was instant, and argued that this should also be as straight forward as it is in the case of Bank of England, London, while simultaneously her facial expressions conveyed me that she wanted to know, if I dare to differ from her opinion. Certainly, I had to differ, and added that things are not always as simple as they seem to be. The statistics again came handy in quoting that “estimates suggest that the total amount of physical gold with J P Morgan currently stands at around 338,303 ounces (1 troy ounce equals 31.1 grams).”

Now, it seemed that she was out of reasons, as she expressed her ignorance about having to come across any news in media regarding, such a huge bank robbery in which approximately 1,11,697 ounce or 3473.8 kilo grams worth gold was looted. I had to instantly chip in by saying that, this is not a case of bank lifting, but a way of functioning of financial system in general and banking sector in particular. Let me add an example to illustrate it? I sought her permission. The phenomenon goes as explained ahead [the attempt was to explain the process by making it as easy as possible, so that even a novice can understand].

“Central banks around the world had a huge amount of gold lying in their vaults, not earning any return. The end of 2007 witnessed the stock of gold with central banks around the world rising to 32,000 tonnes of gold.”

I requested her to be more attentive to whatever I was going to add now. Out of the 32,000 tonnes gold held, the Central Bank lent approximately 14,000 tonnes to Bullion Banks like J P Morgan. James Turk and John Rubino in their coauthored book The Collapse of the Dollar, have argued that “lending, for instance, involves the central bank transferring gold to a major private bank, known as bullion bank, which pays the central bank a small-but-positive interest rate, then sells the gold in the open market.”

In this manner “central banks convert the gold into cash and then deploy this cash, somewhere to earn some positive rate of return. This based on a very fundamental assumption that idle assets provide no return, and there is fair possibility that such assets may ultimately add up some cost to the holder.” These costs may range from cost of storage to cost of security. As per meaning conveyed by the operative word “lending”, since the gold has been lent, therefore, the central banks have all the rights to, and can demand it back, whenever they want.

She chipped in by adding that probably “this is what Venezuela is doing right now”; and thus conveyed me a feeling that she was sincerely following the every single word uttered by me.

I nodded in agreement and continued further by adding that, since, the bullion banks have promised to return the borrowed gold to the central banks so they will have to return the same. In prevailing situations these bullion banks are not having the volume of gold that was lent to them by Central Bank. In financial and monetary world, this position is conveyed by the term ‘short’, and this means that these bullion banks are ‘short’ gold.

Now comes a significant turn in events, that may work as catalyst to force the prices of gold to break the roof. As the situation deliberated above suggests that, in case, sometime in future, these bullion banks are asked to deposit the volume of gold lent to them by central bank, they will be left with no choice and would be obligated to buy gold in order to repay the central banks’.”

“So, as I can get, it goes like, that in such a scenario the bullion banks like J P Morgan will now have to buy back gold from the market in order to repay the Venezuelan government, given the situation that Venezuela has around 450,000 ounces of gold deposited with J P Morgan, whereas J P Morgan at present has only 338,303 ounces of gold in its accounts/ record books,” she added.

Exactly, I said in agreement, and carried the deliberations forward by adding, that this buying will lead to the price of gold rising further. I knew that now she has got answer to her question, but then too, I continued it by saying that this is only one part of the story.

Much like a child, who is curious to know about everything, she was now eager to learn that what the remaining part of story was now. She requested me to unfold the other part of the story.

I continued by giving her a reference of a report titled “Thing That Make You Go Hmmm” , and told that this report points out, ‘Chavez’s move could set in motion a chain of events whereby Central banks who store the bulk of their gold overseas in ‘safe’ locations scramble to repossess their country’s true ‘wealth’. If that happens, the most high-stakes game of musical chairs the world has ever seen will have begun’,” I said.

“This sounds very scary”, she added.

“Yes, you are very much correct while mentioning that the report further states that ‘any delay in repatriating Venezuela’s gold could potentially start a frantic scramble by central banks to claim their physical. God save the scenario, but if it actually happens, rest assured that gold price will be on fire. A scenario will take place, which has neither been seen in past, nor even imagined.

“Yes, you are very much correct while mentioning that the report further states that ‘any delay in repatriating Venezuela’s gold could potentially start a frantic scramble by central banks to claim their physical. God save the scenario, but if it actually happens, rest assured that gold price will be on fire. A scenario will take place, which has neither been seen in past, nor even imagined.

It will give birth to an economic tsunami of magnitude, which will turn the great economic recession witnessed by world or even the jasmine revolution and contribution of social media to same to seem dwarf.

Don’t be surprised if I that there is enough in media to believe U S Govt. Manufactured Fake Gold

Perhaps, there are only few who can imagine the magnitude of risk, specifically if they are not linked to foreign trade. Let me illustrate it. It’s one thing to counterfeit a twenty or hundred dollar bill. The amount of financial damage is usually limited to a specific region and only affects dozens of people and thousands of dollars. Secret Service agents quickly notify the banks on how to recognize these phony bills and retail outlets usually have procedures in place (such as special pens to test the paper) to stop their proliferation.

This is the most sacred of all commodities because it is thought to be the most trusted reliable and valuable means of saving wealth.

A recent discovery — in October of 2009 — has been suppressed by the main stream media but has been circulating among the “big money” brokers and financial kingpins and is just now being revealed to the public. It involves the gold in Fort Knox — the US Treasury gold — that is the equity of our national wealth. In short, millions (with an “m”) of gold bars are fake!.Who did this? None, but the United States Government, as claimed by Chinese Authorities.

Background

In October of 2009 the Chinese received a shipment of gold bars. Gold is regularly exchanges between countries to pay debts and to settle the so-called balance of trade. Most gold is exchanged and stored in vaults under the supervision of a special organization based in London, the London Bullion Market Association (or LBMA). When the shipment was received, the Chinese government asked that special tests be performed to guarantee the purity and weight of the gold bars. In this test, four small holed are drilled into the gold bars and the metal is then analyzed.

Officials were shocked to learn that the bars were fake. They contained cores of tungsten with only a outer coating of real gold. What’s more, these gold bars, containing serial numbers for tracking, originated in the US and had been stored in Fort Knox for years. There were reportedly between, 5600 to 5700 bars, weighing 400 oz. each, in the shipment!

At first many gold experts assumed the fake gold originated in China, the world’s best knock-off producers. The Chinese were quick to investigate and issued a statement that implicated the US in the scheme.

What the Chinese Uncovered

Roughly 15 years ago — during the Clinton Administration [think Robert Rubin, Sir Alan Greenspan and Lawrence Summers] — between 1.3 and 1.5 million 400 oz tungsten blanks were allegedly manufactured by a very high-end, sophisticated refiner in the USA [more than 16 Thousand metric tonnes]. Subsequently, 640,000 of these tungsten blanks received their gold plating and WERE shipped to Ft. Knox and remain there to this day.

According to the Chinese investigation, the balance of this 1.3 million to 1.5 million 400 oz tungsten cache was also gold plated and then allegedly “sold” into the international market. Apparently, the global market is literally “stuffed full of 400 oz salted bars”. Perhaps, its worth is as much as, 600-billion U S dollars.

Always Yours — As Usual — Saurabh Singh

RELATED LINKS FOR READERS WHO WANT TO GO IN MORE DETAILS TO BEFORE COMMENTING ON STORY

- http://etfdailynews.com/2011/08/17/venezuelan-president-hugo-chavez-sends-precious-metal-etfs-a-wakeup-call-gld-iau-slv-gdx-agq/

- http://philosophers-stone.co.uk/wordpress/2011/08/hugo-chavez-gold-runs-bank-runs-and-bank-holidays/

- http://profit.ndtv.com/news/show/chavez-officially-nationalizes-venezuela-s-gold-industry-174207

- http://notime4bull.com/aggregator/sources/13

- http://mikepiro.com/blog/as-chavez-pulls-venezuelas-gold-from-jp-morgan-is-the-great-scramble-for-physical-starting/

- http://www.theglobeandmail.com/report-on-business/industry-news/energy-and-resources/traders-brace-for-venezuela-gold-transfer/article2134031/print/

- http://www.bighaber.com/haber/chavez-to-nationalize-venezuelan-gold-industry-1072000.html

- http://www.advisorperspectives.com/commentaries/global_082611.php

- http://americasfinancialmeltdown.blogspot.com/2010/11/below-is-antiwar_4391.html

- http://mikepiro.com/blog/ron-paul-audit-federal-reserve-gold-stores/

- http://www.freedomsphoenix.com/News/061976-2009-11-26-us-govt-manufactured-fake-gold.htm

- http://www.the-boondocks.org/forum/index.php?t=msg&&goto=157202#msg_157202s

Impressions of Visitor & Few Replies